Allowed!

- Home Feature

- Paid

- Home

This method carries an amount of exposure, thus people can benefit off handling a monetary specialist so you can influence their finest routes pass.

Loading.

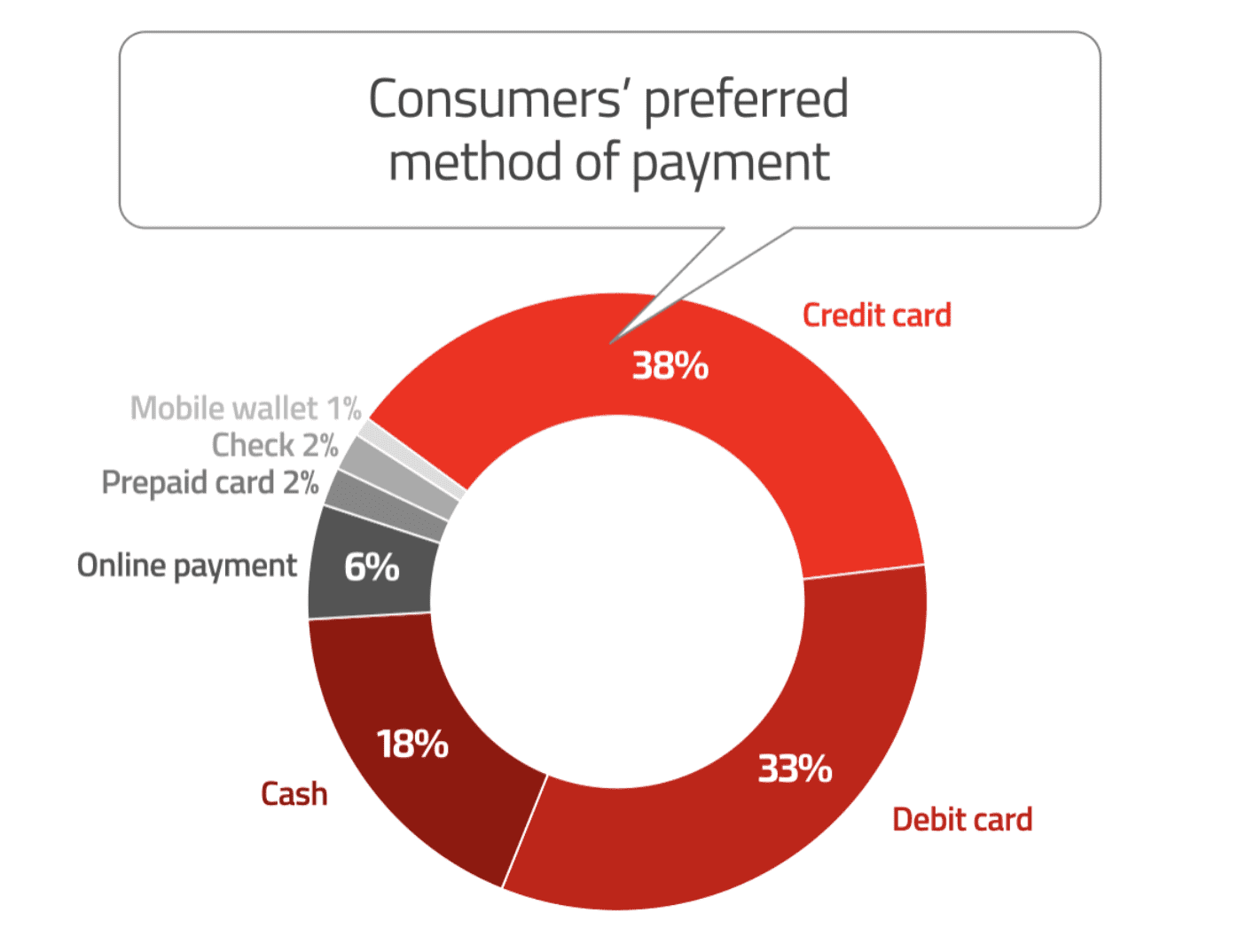

Personal credit card debt you may give up the latest economic defense and well-getting away from an incredible number of some body. According to the Federal Set aside Bank of brand new York, Americans’ complete mastercard harmony regarding next one-fourth away from 2023 is more $1 trillion, and you will LendingTree account your mediocre bank card balances certainly You.S. cardholders into the are $eight,279. Mediocre balance is actually straight down but nonetheless an issue for the Canada, in which studies from TransUnion ways an average cardholder had a great balance out-of $step 3,909 since the initial one-fourth away from 2023.

The common bank card stability both in the latest You.S. and Canada strongly recommend many people are placing their monetary futures when you look at the jeopardy by counting as well heavily toward borrowing from the bank to cover its life-style.

Rising loans is the the new truth

/cloudfront-us-east-1.images.arcpublishing.com/gray/VQSNAW44CVBSRNWYJRZGAW6KZY.jpg)

Debt has been a major concern having households across the North America. People are are hit by highest will set you back everywhere, that is compounding financial obligation. Those people worried about the debt is talk to an economic elite while they seek to acquire command over the profit.

$ trillion Complete domestic obligations in the third quarter regarding 2023 for the the united states, largely motivated by mortgage loans, handmade cards and you can education loan stability. The brand new Federal Set aside Financial of the latest York Heart getting Microeconomic Analysis

$21,800 Last year’s average loans per private, leaving out mortgage loans. It count try down out-of $29,800 when you look at the 2019. Northwestern Common

Luckily for us people are apt to have a sense of self-sense about their borrowing from the bank use, just like the a recent NerdWallet survey greater than 2,000 adult people found that 83 per cent out of participants accepted it overspend. Identification out-of an overhead-reliance on borrowing is a substantial first step toward eradicating financial obligation, and customers whom individual their homes will get envision family guarantee finance otherwise personal lines of credit in order to tame the debt.

The user Economic Safety Bureau notes that a home guarantee loan allows people so you can borrow money using the equity in their house because the security. Security ‘s the matter property is currently value with no matter already owed towards a home loan. Anytime a property deserves $500,000 and residents has actually a home loan equilibrium out of $3 hundred,000, up coming their equity are $200,000.

One of the largest issues when consumers wrack upwards loads of credit card debt is the possibilities that they’ll become spending substantial amounts of focus thereon debt. That is because playing cards normally have higher interest rates. In fact, the new LendingTree records one to also users which have good credit might have an annual percentage rate to 21 per cent to their credit cards. You to definitely shape just grows to possess users having straight down credit ratings. Bankrate notes your average interest rate for a house collateral financing is typically reduced versus price for the playing cards, so home owners normally officially help save a fortune by paying off their personal credit card debt having a property security loan.

Even in the event down rates of interest and you can consolidated personal debt are a couple of advantages to settling unsecured debt having a property equity financing, that one try risky. Probably the most significant risk for the this process is the possible of dropping a house. People with nice credit debt should become aware of you to without a beneficial major change in using designs, playing with a property collateral mortgage to settle personal debt you are going to influence for the property foreclosure. In the event that people do not divert previous borrowing from the bank paying so you can on the-go out month-to-month financing money, they could clean out their home. Simultaneously, Bankrate notes that in case a property is sold with a great house equity mortgage equilibrium, you to definitely harmony have to be repaid at the same time.

Household collateral americash loans Red Feather Lakes finance might help property owners combine and in the end treat its credit debt. not, this approach offers an amount of chance, very property owners can benefit of working with an economic mentor in order to determine how to pay off the present debts.